Each month I take a detailed look at sales in the new generic top level domain (ngTLD) extensions. You can see the full report from the most recent reporting period here. It provides analysis by extension, sales venue, and domain type, as well as listings of the top price sales, some particularly effective domain names that sold this month, and a list of names that recently sold for bargain prices.

The report covers the 30 day period from Oct 23 through Nov 22, 2018. All data is extracted from the NameBio database, and what is included in that database, and what is not, should be kept in mind.

Here at NameTalent I take a look at what insights domain investors might derive from each report. For example, my previous NameTalent monthly report on ngTLD sales pointed out that Dynadot seemed to be developing into a significant aftermarket sales venue for ngTLD domains.

Summary

Let’s first look at the key statistics from the reporting period (see here for full report).

- 88 NameBio recorded ngTLD sales in the 30 day period,

- Approximately $257,000 total sale volume.

- The average price was $2920.

- The median price was $1404.

- In terms of major sales in the month, 11 were > $5000 and 57 > $1000.

- Sales occurred in 24 different extensions.

- There were sales during the month at 12 different venues.

- Most ngTLD sales are either single word or very short (or both).

- Registries accounted for almost 51% of dollar volume and 27% by number of the sales in this report.

- In 2018 YTD there have been 1363 ngTLD sales listed on NameBio, with an average price of $3606. Sales volume is just over $4.9 million YTD.

In the next sections we extract some insights for domain name investors based on the analysis.

Type of ngTLDs That Sell

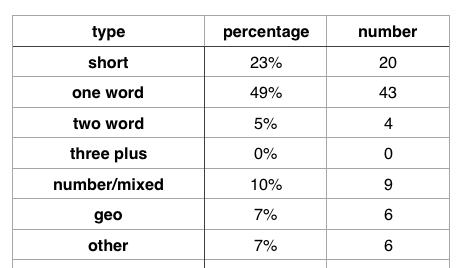

Within the new domain extensions a significant majority of domain names are either single words or short acronyms. In this report about 72% of the sales came from these two categories combined. I show the full breakdown by type in the accompanying chart.

Only rarely should new domain extension investors invest in multiple word domain names unless they are investing with a very long time frame outlook.

While geo names do sell to some degree, sales of this type are infrequent, particularly outside China. Numbered, or number-letter combination, ngTLDs did sell 9 times during the reporting period. In the case of 6M.top the name sold for almost $7000.

Extensions

Those unfamiliar with ngTLD domain investing incorrectly look at past sales in an extension as the key predictor of likelihood for a domain name to sell. As we cover in the next section, it is far more important, in general, how good the match is on the two sides of the dot.

The key change is that .company extension domain names have started selling at good rates (8 sales in the month, all above $1000).

Nevertheless the full report does give a breakdown by extension. The key change that domain investors should note from this report is that .company extension domain names have started selling at good rates (8 sales in the month, all above $1000). The registration and renewal rate on most names in this extension are reasonable, and I think that it makes sense as an investment. I personally picked up two in the last couple of months based on the recent sales record.

Match Is All Important

While there are exceptions, in general ngTLDs that sell for good prices have an excellent match between the two sides of the dot. A number of superb match names sold during the reporting period, such as new.earth, have.fun, spiritual.life, preserve.life, service.express, cloud.team, hide.online, la.maison, physician.world and venture.world.

In general ngTLDs that sell for good prices have an excellent match between the two sides of the dot.

There are exceptions to the rule about match, since in extensions like .top,.xyz, .gdn, .site and a number of others it is not so much the match as the quality of the word to the left of the dot.

Where To Sell

The full report shows number of sales and sales volume broken down by venue. Sedo, Dynadot and Uniregistry were all active. Flippa stopped being active during this period, possibly related to their recent list pricing changes. Sales of ngTLDs are rare at GoDaddy Auctions and essentially absent in NameJet auctions (at least in data that is reported to NameBio). I suspect that the vast majority of sales of ngTLDs are at Undeveloped, Efty sites, and various registrar marketplaces, and therefore not reported to NameBio.

Who Is Buying

While most of the time it is a guessing game (at least until a website is developed) who is purchasing a domain name and for what purpose, I think there is some evidence that ngTLDs are being purchased disproportionately (when compared to legacy extensions) by non-business organizations. For example the major sale of new.earth resolves to a social media site for a global peace movement. I presume that names like preserve.life and spiritual.life are going to be used by non-business entities as well. A number of the .space and .world domain names in use are by non-business organizations.

Pricing

Success in domain investing depends on appropriate pricing. With thin sales records so far, this is particularly challenging for ngTLD investors. Again this month the average and median prices for ngTLD sales are substantially above those for legacy domain sales.

One might argue that the registry sales push up the average prices of ngTLDs (and I am sure that is true), but even if you use the median price, $1404 in this reporting period, it is more than 4 times higher than the median NameBio price for legacy domain extensions such as .com or .net (see for example our weekly NameBio sales data summaries to track median prices on a day by day basis).

Even if you use the median, $1404 in this reporting period, sales prices of ngTLDs are more than 4 times the corresponding median sales values for .com or domain names in general.

At the same time a number of ngTLDs in this reporting period sold at rather low prices for the quality of the names. Some examples would be token.gift $123, cloud.team $137, venture.world $121 and physician.world $204. I think the message is that there is considerable price variability in most of the ngTLDs.

Should You Invest in ngTLDs?

I left the biggest question for last. One month’s data does not really provide much evidence, but we can view this report in the context of the previous 9 monthly ngTLD sales analyses or the year to date.

The fraction of domain names that sell in any one year is lower in ngTLDs than the already low probabilities for .com. That is partly, but only partly, compensated by typically higher prices in ngTLD sales. Strictly by the numbers, currently at least, it is more profitable to invest in .com and a few select country code extensions than in ngTLDs.

The fraction of domain names that sell in any one year is lower in ngTLDs than the already low probabilities for .com.

That being said, clearly some ngTLD domain investors are selling domains at a profitable rate. The keys to success are to emphasize quality (mainly single word domains with excellent match to the extension), stay away from most domains with premium renewal rates, be smart about finding the best rates for renewals and take advantage of multi-year savings, be attuned to trends and new opportunities, and sell at venues that attract ngTLD end users or use outbound techniques effectively. Being successful in ngTLD domain investing requires discipline and hard work.

…emphasize quality (mainly single word domains with excellent match to the extension), stay away from most domains with premium renewal rates, be smart about finding the best rates for renewals, be attuned to trends and new opportunities, and sell at venues that attract ngTLD end users or use outbound techniques effectively.

Only you can decide if ngTLD domain investment is for you. As I have argued previously, one compelling argument for some degree of ngTLD domain investment is adding diversification to a portfolio.

Other Reports

Our next report will be issued in the first part of January and will cover the reporting period through Dec 31, 2018. You can get links to all previous reports on this page. Insights from the preceding monthly report was published on NameTalent at this link. The full report that the current post is based on is available at this link.