I am concerned when I read posts from new domain investors saying something like “I registered 20 domain names last month and they have not sold. What am I doing wrong?” or “I just quit my job and plan to make easy money flipping domain names.” Some of the books written on domain investing perpetuate the myth that it is fast and easy to make big returns in domain investing. Let’s take a look at what the numbers really say about how profitable domain name investment is on average.

A Simple Equation

A domain investment will be profitable if the probability that the domain name sells in any given year multiplied by the net profit on the sale of that domain name is more than your annual holding costs associated with the domain name. The hard part is determining the right numbers for the annual probability that any particular domain name sells as well as the most likely selling price.

For example, if you have 1 chance in 100 that your domain name will sell in any given year, and you anticipate selling it for a net profit of $1800 when all costs are considered, then this would suggest that holding the domain name makes economic sense as long as your annual holding costs are less than $18 (but not otherwise).

A domain investment will be profitable if the probability that the domain name sells in any given year multiplied by the net profit on the sale of that domain name is more than your annual holding costs.

Probability of Selling

We can determine the general average sales probability in any given year by simply dividing the number of domains sold in a year by the number that are actively for sale. Unfortunately neither of these numbers are precisely known. It is easy to see how many domain names sold on NameBio. For example, as of the day I am writing this post there were 81,822 sales in the previous 12 months over all extensions (note the link will show an updated number for the previous 12 months to when you click it).

It is important to realize that not all sales are reported on NameBio, however. For example, Sedo buyers and sellers can choose to pay to keep their sale details private through an optional charge, many venues including Afternic and Undeveloped, private sales, most registry sales, marketplaces at most registrars, and sales through Efty accounts are not normally reported to NameBio. Therefore we must multiply the number of reported NameBio sales by some correction factor to estimate the real number of domains sold. There is debate about this factor, but most suggest that something between 10% and 40% of sales are reported on NameBio.

The other number we need before calculating the per year sales probability is the number of domain names that are actively for sale. Because of the many places that domain names are sold, and the practice of listing in parallel on multiple venues, as well as the fact that some domains continue to be listed even after they have sold or been dropped, it is difficult to precisely estimate the number for sale. Probably the two biggest venues are Afternic and Sedo. At the date of writing Afternic list just under 14 million domain names for sale. I would suggest that the total number of domain names for sale must be at least double this, and perhaps as much as four times this number.

Probable Sales Price

At least for sales reported on NameBio, it is easy to find the average sales price from the statistics reported at the bottom of the search results page. For example, for the last year the average sales price (all extensions) was $1284. There are two factors that need to be taken into account, however.

This is the mean price – meaning you just add up all of the sales and divide by the number of sales. While that might seem like the right number to use, for most individual domain investors they will never hold one of the super premium domain names that attract six or seven figure sales prices. It could be argued that a better measure would be the median price. The median is obtained by simply ordering all of the sales by price, and taking the one that is in the middle. NameBio don’t report the median (it slows down the search too much), but it can readily be calculated for smaller datasets. Normally the median price of .com sales recently on NameBio are slightly over $300, compared to mean prices of more than $1000.

Should you use the mean or the median sales price?

The second factor is that it can be argued that NameBio is weighted to the much lower wholesale prices and if one had an unbiased sample of retail prices the average price would be higher. Certainly many of the NameBio reported sales are from venues like GoDaddy, NameJet, Dynadot, Flippa, etc. that include a lot of domainer to domainer sales.

Net Profit

The average sales price reported on NameBio is the gross price. To get a net price you need to take into account your commission and other costs. This too is difficult to find clarity regarding what should be included. Clearly costs such as the price paid for the domain name, commission on the sale, costs like a seller portion, if any, of escrow costs, payment related costs, etc. should be taken into account. In addition there are possible business or legal costs, listing fees, evaluation or logo charges, etc.

Note that in the model we are presenting we do not include costs for annual services like Efty, domain intelligence services, web hosting, etc. in the net profit calculation. Rather we include those (on a per domain per year basis) on the annual costs line that will be compared to the probable annual return on the domain. Many of these costs are not per domain, and the size of the portfolio will influence how much we should.

Another question is how much should be added for the cost of your time in handling the domain. It takes time to acquire a domain, keep it registered, list it on marketplaces, write a compelling sales case, possibly do outbound marketing, interact with potential clients, etc. If you are in domain investing as a business, part-time or full-time, clearly you should account for the worth of your time. If, however, you are in domain investing as a hobby, you might not want to include a line item for the value of your time.

How much do you value your time at?

It is true that you should also have a cost of money invested line. The funds you have tied up while holding a domain name could be making perhaps 1.5% in a high interest account, 3% in a GIC or 6% in a balanced mutual fund or exchange traded fund. In the models here we have excluded this cost, but it is definitely a business consideration.

The Numbers

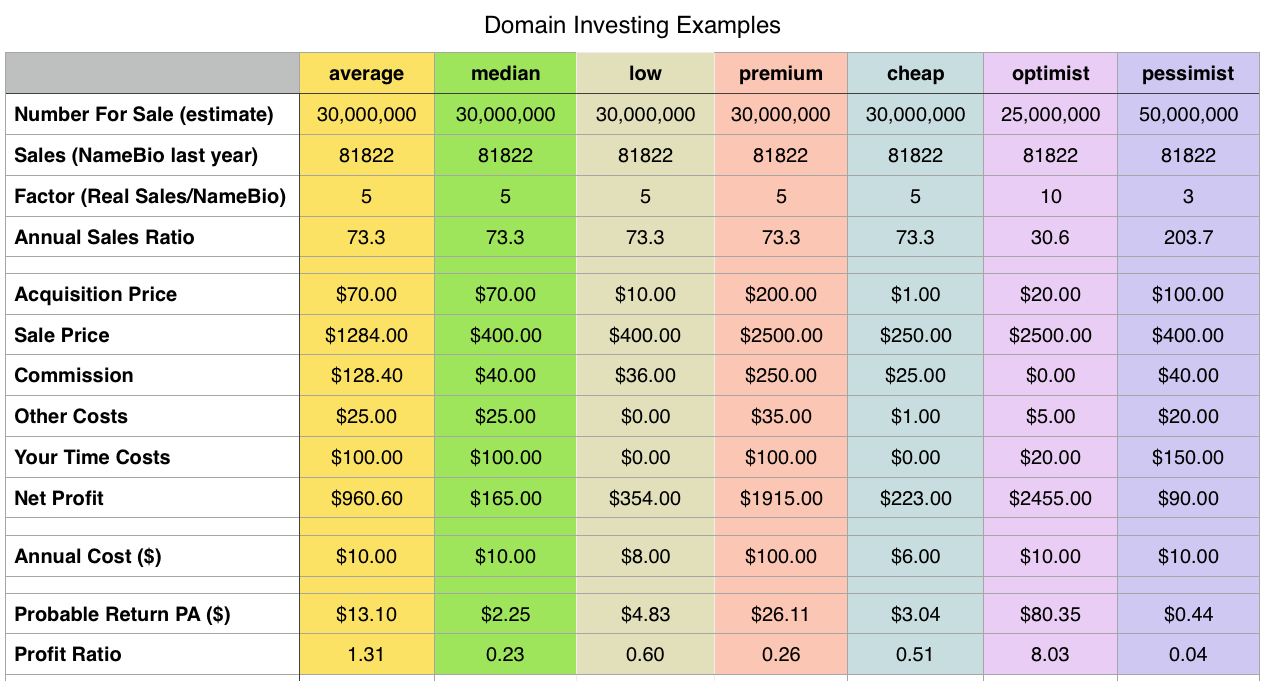

I put the above together in a table with different model scenarios. Here are brief explanations of the line items.

- Number for Sale: I estimate the number of domain names actively for sale at 30 million

- Sales is the annual number of NameBio listed domain sales in the most recent 12 months (about 82,000).

- Factor: I assume that NameBio sales represent 20% of total sales, and therefore use a correction factor of 5.

- Annual Sales Ratio is obtained by simply dividing the number of domains for sale by the estimated total number for sale. The numbers we use suggest on average about 1 in every 73 domains sell in any one year.

- Acquisition Price is simply the price paid to register or purchase the domain name. Note that all prices used here are in USD.

- Sales Price is the gross price at which the domain name sold.

- Commission: Most domains are sold via a marketplace that charges a commission. We have assumed 10% in the calculations except as otherwise noted.

- Other Costs: As described earlier you will probably have other costs either directly or indirectly associated with the domain name sale.

- Note that we do not include the renewal costs or annual costs for services like web hosting in net sales profit since those numbers will enter into the annual cost line.

- Your Time Costs is how much value should be allocated for your time over the lifetime of holding this one domain name.

- Net Profit is simply the difference between your gross sales price and acquisition cost, when other costs including your time costs, but not annual costs, are also taken into account.

- Annual Cost is your renewal cost for this domain name plus the annual costs (on a per domain basis) of services like Efty, WebHosting, etc.

- Average Per Annum Return: We multiply your net profit by the probability of selling in any one year to obtain this value. If it is higher than the annual cost, it suggests that the domain investment is profitable.

- Profit Ratio: This is the ratio of the two previous lines. A value above 1.00 suggests a positive scenario.

Model Cases

Using the mathematical relationship described here, we put in actual numbers for a number of cases as indicated by the different coloured columns.

Average

The first (average) is our best attempt at an industry wide figure. We assume an average acquisition wholesale cost of $70 and that the domain name sold at the NameBio average price. We assume 10% commission along with $25 for other costs, and have somewhat arbitrarily assumed that your time for this one domain name is worth $100. We assume that you were able to get a very competitive renewal cost and that you had only minor other annual costs. Perhaps you did not use a website or Efty, or because you have a large portfolio the per domain cost is small. With a ratio of 1.31 this suggests that overall your prospects are promising, although only modestly so.

Median

If rather than using the average sales price you use the median price, recognizing that the median better represents the sales price you are likely to have, then the results suggest that, on average, domain investing is not profitable. The ratio is actually only 0.23 as indicated in the green column. T

Low

The low model looks at what you would expect if you hand registered the domain name to reduce acquisition cost, found a commission at 9%, totally eliminated other costs, and put in nothing for the value of your time. We assume a sale at a median price of $400 (slightly above actual recent NameBio .com median values). While the ratio has been moved closer to the breakeven point, it is still only 0.60, so the odds suggest you would overall lose money.

Premium

The premium model is meant to correspond to investment in a premium country code or new domain extension. We have, somewhat arbitrarily, assumed an acquisition cost of $200 and an annual cost of $100. We assume that the domain name sells at $2500, representative of premium names. Still the model suggests less than breakeven prospects with a ratio of 0.26.

Cheap

Many new domain investors concentrate at first on new extensions that they hand register for small amounts. We wanted to look at a model that dealt with that situation. We assume that the domain name only sells for $250 but that you managed to register it for $1 and perhaps with multi-year discounts have an average annual cost of just $6. Even if you value your time at nothing, the ratio is just 0.51 for this model.

Optimist

The last two models tried to look at the most optimistic and pessimistic scenarios. In the optimistic scenario I assume that NameBio only represents 10% of actual sales, so the correction factor is 10. I also assume that there are only 25 million domain names for sale. I further assume that NameBio average prices under represent true average prices by a factor of about two, so assume an average sale price of $2500. I assume only $20 value on your time spent, so the overall ratio is a very optimistic 8.0.

Pessimist

In the pessimist model it is assumed that there really are 50 million domains for sale and that NameBio only under represents actual sales numbers by a factor of 3. I use the median sales price and assume $150 per domain name as value of your time spent (probably still under representing real costs). The pessimistic result is not even a ratio of 0.1 for probable return ratio. Indeed things are pessimistic with this model!

Discussion

The models suggest that it is challenging to do more than break even in domain name investing. Those who are successful have managed to develop excellent skills at recognizing which domain names sell, expertise in obtaining high sales prices, and been alert to keeping costs low. They also have made good decisions regarding which domain names are worth continuing to hold.

Those who are successful have managed to develop excellent skills at recognizing which domain names sell, expertise in obtaining high sales prices, and been alert to keeping costs low.

It is of course easy to find anecdotal cases where an individual domain flip was hugely profitable, where a name bought for $20 was flipped for four or five figures a few years later. It is only human nature to give attention to these success stories, but they should not blind us to what is the typical situation. Nothing in this post says that it is impossible to make huge margins on domain activities, but the calculations do show that for most of us, most of the time, it will be challenging.

In this post I have looked at an average over all domain extensions. The market is so dominated by .com that the picture for .com alone would not be much different. I have argued elsewhere that the sales probability for new dimensions are probably less favourable a factor of 3 or 4 when compared to .com. Therefore if we looked only at new extensions the picture would be even more bleak than the one presented here.

Future posts will provide more depth to how you can estimate the probability of sale of an individual domain name and better predict sales price for specific domain names. Being better informed can help you increase the chances of being successful in domain investing. One key to success is to be discriminating in each of your domain name acquisitions, a topic we covered in our previous post.

While the overall picture presented here may be discouraging, we should also keep in mind that a number of domain investors have been successful year after year over an extended period in the business. As with any statistical argument, they show a general picture, not what applies to any one person. Outside domain investing most startup businesses fail within a decade. That does not mean that your startup will necessarily fail. Being quantitative in your business plan model will both force you to have realistic expectations and to make logical domain investing choices.

Wow. Phenomenal article, Bob. We need more methodology and logical practices in this industry. I don’t think enough investors take the time to evaluate their portfolios from a probability perspective. This should be extremely helpful to newcomers and veterans alike.

I can’t wait to read more!

Thank you so much for your generous comments, and taking the time to write, Ed! I am still learning every day in domain investing, but what most interests me is to pose a question and try to answer it with evidence in a balanced and fair way.

[…] it is true that the average price also comes into the financial viability relationship, and that favours new extensions. However, even if we take that into account legacy .net/.org are […]

[…] posed less than a month ago the simple question “Is domain investing profitable?’ I mean obviously […]

[…] in any one year, as well as the likely selling price and the net profit. We covered the basics on what profitable means in this post. For example, a typical domain name might be estimated to have 1 chance in 100 of selling in […]

[…] suggest a correction factor of 3.7 should be applied to NameBio sales to obtain total sales. The value of 5 often assumed is consistent with the […]